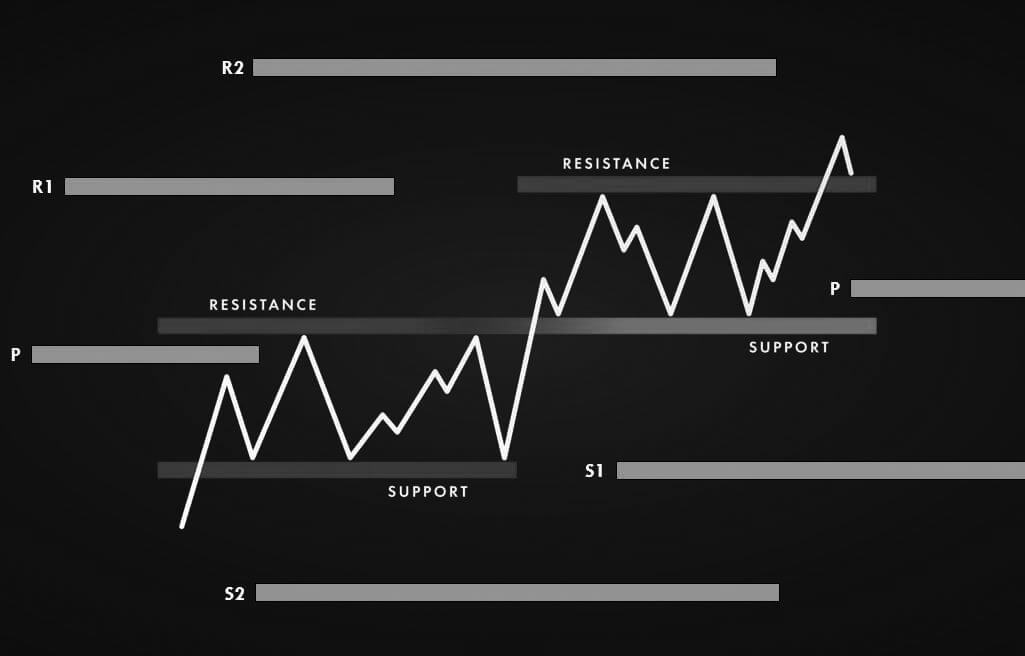

By using the pivot point and its derivatives can help you to minimize the risk and provides forex traders with potential levels of support and resistance. Using support and resistance as starting points helps determine when to enter the market, stop, and take profits. However, many novice traders shift too much attention to technical indicators, including moving average convergence (MACD) and relative strength index (RSI). Although useful, these indicators fail to identify a point that determines risk. The unknown risk can lead to margin calls, but the calculated risk significantly improves the chances of success in the long run.