This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

By using the pivot point and its derivatives can help you to minimize the risk and provides forex traders with potential levels of support and resistance. Using support and resistance as starting points helps determine when to enter the market, stop, and take profits. However, many novice traders shift too much attention to technical indicators, including moving average convergence (MACD) and relative strength index (RSI). Although useful, these indicators fail to identify a point that determines risk. The unknown risk can lead to margin calls, but the calculated risk significantly improves the chances of success in the long run.

In this article, we will discuss why the combination of pivot points and traditional technical tools is more powerful than technical tools in themselves, and we will show the usefulness of pivot points in the foreign exchange market.

Pivot Points

The pivot point is used to reflect changes in market movements and to identify general trends over time, as if they were hinges from which trade moves either high or low. Originally used by some traders on stock exchanges and futures, they are now most commonly used in conjunction with support and resistance levels to validate trends and minimize risk.

Like other forms of trend line analysis, the fulcrums focus on the important links between highs, lows and closing prices between trading days; that is, the previous day’s prices are used to calculate the pivot point for the current trading day. Although they can be applied to almost any trading instrument, pivot points have proven to be extremely useful in the foreign exchange (FX) market, especially when trading currency pairs.

Forex markets are very liquid and trade very large volumes, which reduce the impact of market manipulation, which could otherwise hamper the forecasts for support and resistance generated by the pivot points.

Support and Resistance Levels

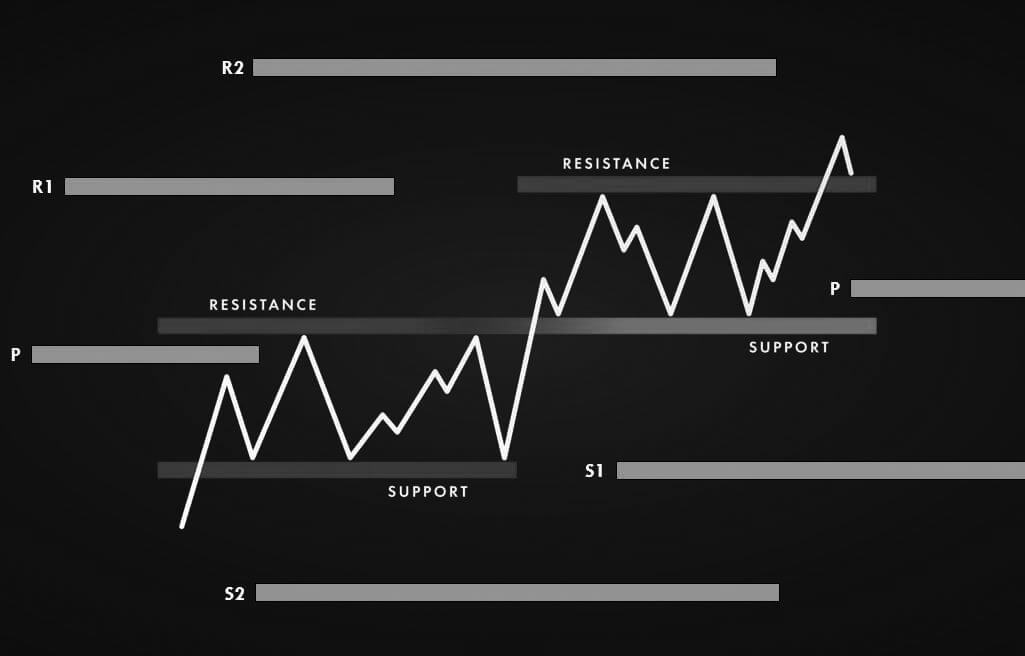

While fulcrums are identified on the basis of specific calculations to detect important levels of resistance and support, the levels of support and resistance themselves rely on more subjective placements to identify trading opportunities.

Support and resistance lines are a theoretical construction used to explain traders’ apparent reluctance to push the price of an asset beyond certain points. If the bull trade appears to be rising steadily before stopping and re-tracking / reversing, it is said to have met resistance. If the bear trade appears to have bottomed out at a certain price point before trading consistently again, it is said to have met with support. Traders are looking for prices to break certain levels of support / resistance as a sign of developing new trends and a chance for quick profits. Many trading strategies rely on support / resistance lines.

Calculating Pivots

You can calculate the points of support and resistance between currencies in a forex pair with several formulas. These values can be tracked over time to assess the likelihood of prices passing certain levels. The calculation starts with the prices for the previous day:

Then the estimated support and resistance for the current trading day can be calculated by the pivot point.

Resistance 1 = (2 x Pivot Point) – Low (previous period)

Support 1 = (2 x Pivot Point) – High (previous period)

Resistance 2 = (Pivot Point – Support 1) + Resistance 1

Support 2 = Pivot Point – (Resistance 1 – Support 1)

Resistance 3 = (Pivot Point – Support 2) + Resistance 2

Support 3 = Pivot Point – (Resistance 2 – Support 2)

To fully understand how well the pivot points can work, compile EUR / USD statistics on how far each high and low level is from each calculated resistance (R1, R2, R3) and support level (S1, S2, S3).

To do the calculation yourself:

- Calculate the pivot points, support levels and resistance levels for x number of days.

- Subtract the pivot points from the actual bottom of the day (low – S1, low – S2, low – S3).

- Subtract the resistance rotation points from the actual maximum of the day (High – R1, High – R2, High – R3).

- Calculate the average for each difference.

The results since the beginning of the euro (1 January 1999, with the first trading day on 4 January 1999): 1

- The actual bottom is on average 1 pip below Support 1.

- The actual maximum is on average 1 pips below Resistance 1.

- The actual bottom is an average of 53 pips above Support 2.

- The actual maximum is an average of 53 pips below Resistance 2.

- The actual bottom is an average of 158 pips above Support 3.

- The actual maximum is an average of 159 pips below Resistance 3.

Judging Probabilities

Statistics show that the calculated pivot points of S1 and R1 are a decent indicator of the actual high and low of the trading day.

Going one step further, we calculated the number of days in which the low level was lower than each S1, S2 and S3 and the number of days in which the maximum was higher than each R1, R2 and R3.

The result: there are 2,026 trading days from the start of the euro on 12 October 2006.

●The actual low level is lower than S1 892 times, or 44% of the time.

●The actual maximum was higher than R1 853 times, or 42% of the time.

●The actual low level is lower than S2 342 times or 17% of the time.

●The actual maximum was higher than R2 354 times, or 17% of the time.

●The actual low level is 63 times lower than S3, or 3% of the time.

●The actual maximum was 52 times higher than R3, or 3% of the time.

This information is useful for the trader; if you know that the pair slips below S1 44% of the time, you can place a stop below S1 with confidence, understanding that the probability is on your side. In addition, you may want to take a profit just below R1, because you know that the maximum for the day exceeds R1 only 42% of the time. Again, the odds are with you.

However, it is important to understand that these are probabilities, not certainties. On average, the maximum is 1 pips below R1 and exceeds R1 42% of the time. This neither means that the maximum will exceed R1 four days out of the next 10, nor that the maximum will always be 1 pips below R1.

The strength of this information lies in the fact that you can confidently assess potential support and resistance ahead of time, have benchmarks for setting stops and limits, and, most importantly, limit risk while putting yourself in a winning position.

Applying the Information

The pivot point and its derivatives are potential support and resistance. The examples below show a setting using a pivot point along with the popular RSI oscillator.

RSI Divergence at Pivot Resistance/Support

This is typically a high reward-to-risk trade. The risk is well-defined due to the recent high (or low for a buy).

The pivot points in the above examples are calculated using weekly data. The above example shows that from 16 to 17 August R1 behaved as a solid resistance (first round) at 1.2854 and the RSI discrepancy suggests that the increase is limited. This suggests that it is possible to make a short break below R1 with a stop at the recent peak and a limit at the pivot point, which is now the support level:

- Sell briefly at 1.2853.

- Stop at the last peak at 1.2885.

- Rotation point limit of 1.2784.

This first trade netted a profit of 69 pips with a 32 pips risk. The remuneration to risk ratio is 2.16.

The following week produced almost the same setting. The week started with a rally to and just above R1 at 1.2908, which was also accompanied by a bearish discrepancy. The short signal is generated when the drop back below R1, at which point we can sell short with a stop at the recent peak and a limit at the pivot point (which is now support):

- Sell briefly on 1.2907.

- Stop at the last peak of 1.2939.

- Rotation point limit of 1.2802.

This trade made a profit of 105 pips with only 32 pips risk. The remuneration to risk ratio is 3.28.

Rules for Setup

For bearish and short traders on the market, the approach to determining pivot points is different than for the bullish, long trader.

For shorts

- Identify bearish divergence at the point of rotation, R1, R2 or R3 (most commonly in R1).

- When the price falls back below the reference point (this can be the pivot point, R1, R2, R3), initiate a short position with a stop of the recent high movement.

- Place a limit (take-profit) order on the next level. If you have sold on R2, your first target will be R1. In this case, the former resistance becomes a support and vice versa.

For a long time

- Identify a bullish divergence at the pivot point, S1, S2 or S3 (most common in S1).

- When the price rises above the reference point (this can be the pivot point, S1, S2, S3), initiate a long position with a stop of the recent low movement.

- Place a limit (take-profit) order on the next level (if you bought on S2, your first goal will be S1 … the previous support becomes resistance and vice versa).

The Bottom Line

Pivot points are changes in the direction of the market that, when placed sequentially, can be used to detect general price trends. They use the high, low and closing values of the previous period to assess the levels of support or resistance in the near future. In technical analysis, pivot points may be the most commonly used leading indicators. There are many different types of pivot points, each with its own formulas and derivative formulas, but their default trading philosophies are the same.

Pivot points can also indicate, when combined with other technical tools, if there is a large and sudden influx of traders entering the market simultaneously. These market inflows often lead to breakthroughs and profit opportunities for currency traders tied to a range. Pivot points can be used to predict which important price points should be used to enter, exit or place stop losses.

You can calculate the pivot points for any time frame that you need. For day trading can be used the daily data to calculate the pivot points for every day, for swing trading can be used the weekly data to calculate the points for each week, and for position trading can be used monthly data to calculate the pivot points at the beginning of each month.

Investors can even use annual data to approximate significant levels for next year. The philosophy of analysis and trade remains the same regardless of the time frame. That is, the calculated pivot points give the trader an idea of where the support and resistance are for the next period, but the trader must always be ready to act – because nothing in trading is more important than readiness.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.