This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

In the topics covered so far, we learned how to analyze the market, where the entry and exit points should be, where to place a stop and where the order limit. If we have mastered all these techniques, we can say that we are ready to trade in the markets, but is it really so. If we can correctly predict the direction of the market, will we win?

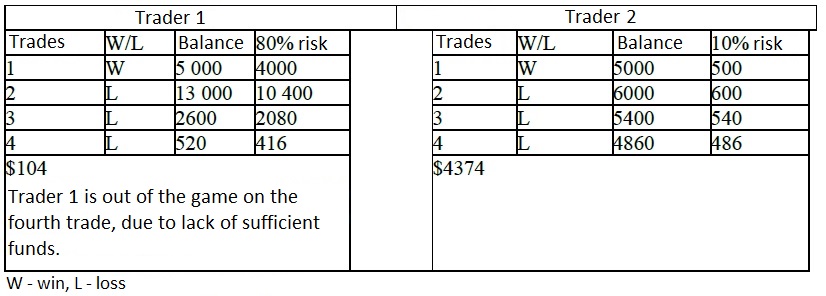

Let’s look at the following example: we take two traders with different approaches to trading. For ease, we will assume that they are equally good and open the same deals. Both start at $ 10,000. The first trader risks 80% of his capital and the second only 10%. Let’s assume that in a winning deal they will win twice what they risked.

Let’s follow their trades.

The table shows that initially Trader 1 led the rankings with a stunning lead, but then when they both enter a losing period, he leaves the game. Assuming that after the losing period both traders will entering a winning period, only Trader 2 will benefit from it.

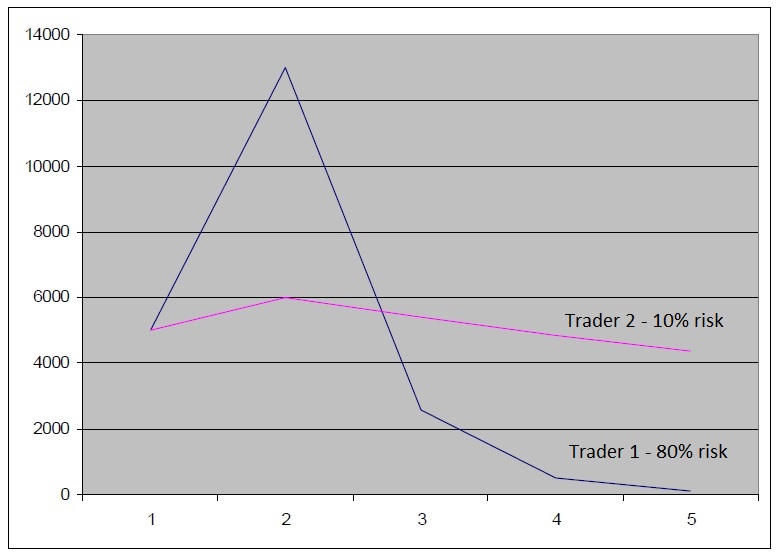

The figure shows even better the difference between the two types of trade.

From this example it is clear that despite the fact that both traders enter into the same transactions, only one continues to trade.

Here is the key importance of money management. No matter how good analysts we are, if we risk a large part of our account, even a small (common) series of losses can throw us out of the market.

Therefore, in addition to a good analysis, we must carefully consider how much of our capital to risk. In order to survive during a losing streak, wait for the winners.

There are many theories about how much of your account to risk. Some use formulas to calculate the percentage to take a risk, while others try to minimize the risk and optimize the percentage of profit. We will not consider these theories, we will only show the basics of money management, what is most important and mandatory to use.

Speaking of money management, we must keep in mind a few things:

Never use the Martingale system

Know what percentage of your money to risk for a deal

To know what Core equity is

Expected profit / allowable loss ratio

There is an approach according to which with each subsequent loss we must double the risky amount. For example, if we risked 20% of the account for the first position, in case of a loss for the next position we have to double this percentage to 40% in order to cover the initial loss and make a profit, i.e. losing we increase the size of transactions. This approach is known as the Martingale system and is based on the statement that after each subsequent loss our chance to win is bigger.

This is not true. Regardless of the successive losses, according to the theory of probabilities, the percentage for each subsequent transaction will be it is 50% profitable.

Regardless of how we trade, what system or methods of analysis we use, we will be confronted with a simple market truth:

– in our trade we will have periods of profit and periods of loss

Depending on the style and way of trading we have chosen, these periods will be of different duration. Therefore, our goal is to minimize losses when entering a losing period (losing series) and to optimize them when winning a series. Therefore, applying the Martingale system, the only thing we will achieve is to maximize losses, and in a winning period not to do nothing.

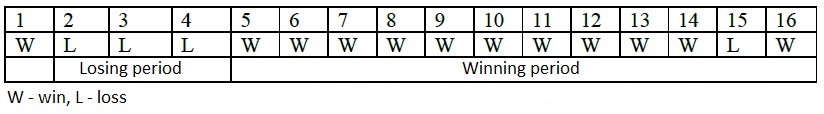

Let’s look at the following Table.

This diagram shows sixteen exemplary transactions and their results. If we risk a large part of our money on any trade, we will most likely lose all the money in the losing period without being able to wait for the winner. In other words, we will miss a series of ten winning positions just because we risked everything in a hurry.

Therefore, the Martingale system is fundamentally wrong and should not be used. On the contrary, instead of increasing venture capital at a loss, it is more appropriate to reduce it. Conversely – in case of a winning series we have to increase the traded amount.

Note: In case of a winning series, we increase the risky amount. As a percentage, the risk remains the same, but already applied to the new amount equal to the amount of the original and the profit.

Let’s now look at the specific rules for successful implementation of money management:

- Never use the Martingale approach

- Never risk more than 1-3% of your capital for one trade. It is recommended that this risk be 1%

- For each subsequent transaction, risk the same percentage of the remaining balance. The residual balance is equal to the initial balance minus the amount set aside for previous transactions

- To add to an already open position, never exceed the initially risky amount. It is advisable to risk a smaller amount than the initial position

- The risk amount for all transactions must not exceed 30% of the total amount. This means that you do not open more positions when the residual balance reaches 70% of the total balance

- Try to make the expected gain / loss ratio greater than one. It is good for this ratio to be greater than 2 or for the profit you expect to get from the trade to be twice the amount you want to risk. Ie Your order limit should be twice your stop. If for a given transaction this coefficient is a number less than 1, it means that the possible profit will be less than the amount we are willing to risk. In other words, profit does not justify the risk.

- If possible, diversify your portfolio by trading in different markets: stocks, currencies, commodities, etc. When diversifying your account into a portfolio of different instruments, always consider the amount of the risk amount with the degree of risk of the instrument. For example, in the Forex market the risk is higher than in the stock market and even greater than in the bond market.

Example of applying money management

Assume the following:

- Your broker’s account is $ 10,000

- Margin 1: 100

- You risk 1% of your capital for each transaction

You will risk $ 100 for each trade. Suppose that after your analysis you decide to trade EUR / USD, as the stop order will be placed at 50 pips from the opening price of the position. Risking $ 100 for a stop of 50 pips, that’s $ 2 per pips. With a mini lot of EUR / USD 1 pips = $ 1 it follows that your position will be of two mini lots. If your stop was 100 pips, the position size would be

one mini lot.

Once you have opened a position in EUR / USD, you already have $ 100, so your residual balance is $ 9900. This means that if you want to open the next trade, you do not have to risk more than 1% of this amount or $ 99.

Optimizing the amount of invested capital

Many of you would wonder what the difference is between risking 1%, 2%, 3% or more. The rules discussed so far illustrate a conservative capital management strategy. A strategy that will protect you from overloading the account and will give you a good foundation to start your career as a trader.

It is during this career of yours, at some point, the question will arise: after we optimize the rules for entering a position, the rules for leaving, the stops, the goals, can’t we optimize this percentage of venture capital as well? Is it possible to use one percent to get better results than another?

If we take a strategy and check by successively setting a risk percentage from 1 to 35, we will see that at a certain percentage the profit is optimized.

There are various formulas with which we can calculate this percentage. They are based on various data from the results, which show the strategies we use: maximum failure, largest loss, average profit and loss, and others.

This means that before we move on to applying a formula for determining the percentage of risk, we must “get to know” our system. That means testing it – researching it in the past. The first option is to program our terms (input, output, etc.) and test for a certain historical period the instruments we will trade. This can be done through the MetaTrader program (see Appendix 1). If your system includes conditions that cannot be programmed, you will need to use the results of your transactions or manually test the system for a historical period. It is important to get data on the already listed parameters: success rate, maximum failure, etc. In order for the application of the formulas to be more valid, your results must be based on a large number of transactions. There is no rule for a specific number of transactions in the test, but it is good that they are over a hundred.

The most famous formulas are the Kelly formula and Ralph Vince’s “optimal F fraction”.

Kelly’s formula.

Kelly% = ((B + 1) * P-1) / B

where: P – probability of a winning deal

B – profit * percentage of winning trades / loss * percentage of losing trades

Kelly’s formula is applicable, it gives correct results only when we have a distribution of Bernoulli – the possible options are two and the gains and losses are well defined.

“Optimal F”.

The optimal F represents such a ratio of the venture capital in each transaction to the total capital, at which the maximum increase of the capital is achieved. In order to correctly calculate the “optimal u” we must have statistics with the results of trade – ie. the amount of gains and losses from a past period or from a trading system survey (see chapter Trading Strategies – “Trading System Survey”).

G = [(1 + f * (-Trade1 / Biggest Loss)) * (1 + f * (-Trade2 / Biggest Loss)) *…

… * (1 + f * (-Tradei / Biggest Loss))] ^ 1 / N

Where: G – geometric mean, expressing the degree of increase of

capital;

f – optimally F;

N – number of transactions;

Trade i – result of the i-th transaction.

The above formula is used to calculate the optimal f as follows: different values of f are set and the one at which the maximum increase of the capital is achieved (G = max) represents the optimal f.

The problem with using the optimal F approach and other capital management strategies is that they find the optimal number of contracts over a period of time. The strategy cannot be relied upon to behave in the same way in the future as the market changes

According to Larry Williams, the winning formula for capital management is as follows:

Account balance * risk rate / largest loss.

Where: a percentage of risk can be obtained by the formula for “optimal u” or the Kelly formula or a percentage consistent with our trading style.

Adherence to a certain money management system is the key to increasing / increasing the effectiveness of your strategy – the key to long-term success.

There are many theories, schemes, strategies on how to manage your money. For the purpose of this book, we have considered only the basis of successful money management, everything you need when starting your trade.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.