This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

All you need to trade currencies is internet access. Trading platforms for forex trading are called MetaTrader 4 and 5 (MT4 and MT5). They can be easily downloaded from every broker’s site. This will be your workplace, if you want to be a trader. You will use it to view and analyze the charts of financial instruments and make your trades.

The leaders among the Forex trading software are The MetaTrader 4 and MetaTrader 5 platforms from MetaQuotes Software Corporation. The fifth version of the terminal was launched in 2010. Since that time, it has been changed and upgraded several times. MT4 platform appeared in Forex brokers’ accounts in July 2005. Currently, both software products develop independently. So, what are the main differences of the 5th and 4th versions of MetaTrader?

MT4 vs. MT5

One of the main questions is what to choose – MetaTrader 4 or MetaTrader 5?

Five years after the release of MetaTrader 4, MetaTrader 5 was released in 2010, at a time when Metatrader 4 was already very popular, and due to the number sequence in the platform names, there is a common misconception that Metatrader 5 was a new improved version of Metatrader 4, designed to do the same job better. This is not really true. MT4 is geared for Forex trading and also contains CFDs, whereas MT5 also provides traders with access to stocks. It can be said, at the same time, that MetaTrader 5 offers a wider range of features.

In first place actually MetaTrader 5 was designed to do some things that MetaTrader 4 could not do. It was aimed at a different market in reality, and thus, there is really very little reason to enter a discussion about “MT4 vs. MT5”.

Essentially, MetaTrader 5 was designed to be able to trade markets other than Forex, such as stocks and commodities, essentially because it is better able to plug into a centralized trading exchange. With a number of major players, Forex market is a completely decentralized market, providing liquidity into this huge market at slightly different prices. Stocks and commodities are traded as a futures contract (several contracts with different expiry dates), must usually be traded through a centralized process before ownership can change hands with full legal effect. It can be assumed that at the time of the MT5 development and release, Metaquotes foresaw a retail stocks and commodities trading boom, and designed the software to fit that market.

The other major differential design factor was its compliance with the U.S.A.’s “no hedging rule”, which states that clients of Forex brokers in the U.S.A. must deal on a F.I.F.O. (first in, first out) basis. This means that if for example a trader goes long 1 lot of EUR/USD, and then goes long an additional 1 lot of EUR/USD, the first trade must be closed before the second trade can be closed. MetaTrader 5 automatically aggregates all positions, while MetaTrader 4 logs every trade individually and allows for management of each individual position separately. Therefore, MetaTrader 5 cannot deal with hedging, only MetaTrader 4 can do that. This is fine for traders in the U.S.A. as they are legally barred from hedging in any case, but in most of the rest of the world, many traders find an inability to execute hedging operations a very annoying an unnecessary handicap. It is probably the major reason why many traders have come to feel annoyed at being “pushed” into using MetaTrader 5 in the place of MetaTrder 4 by their brokers and arguably by MetaQuotes as well. Let’s make a comparison.

Design

From the design point of view, MT5 looks very similar to its predecessor. The workspace of MetaTrader 5 is divided into the same logical parts as MT4: Market Watch, Navigator, Trading, and the financial instrument’s Chart.

The changes have been made only to the design of some buttons. Contextual menu has been updated to offer chart type switching between line, bars, and candles. A layman would not tell any difference between MetaTrader 5 and MetaTrader 4 at a first glance. Visual distinctions are almost absent.

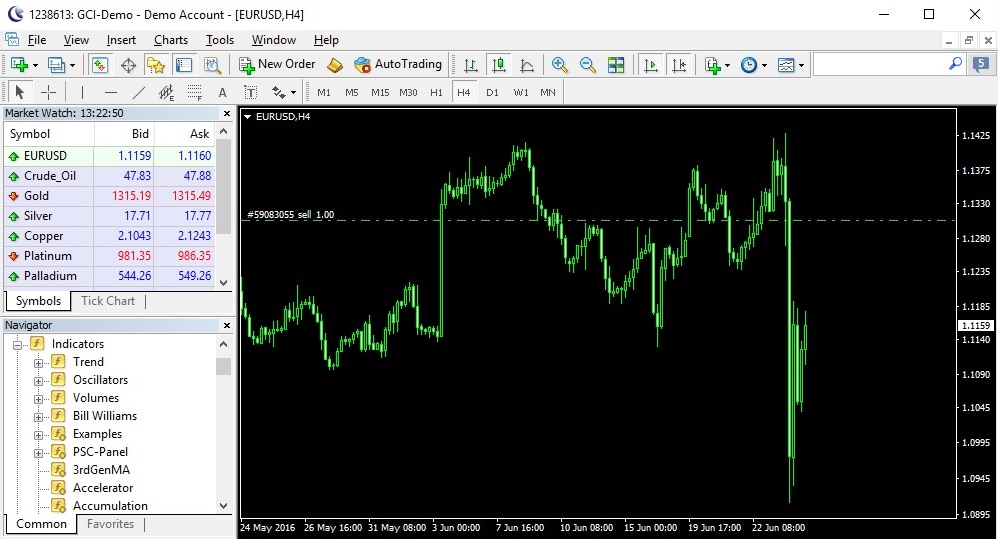

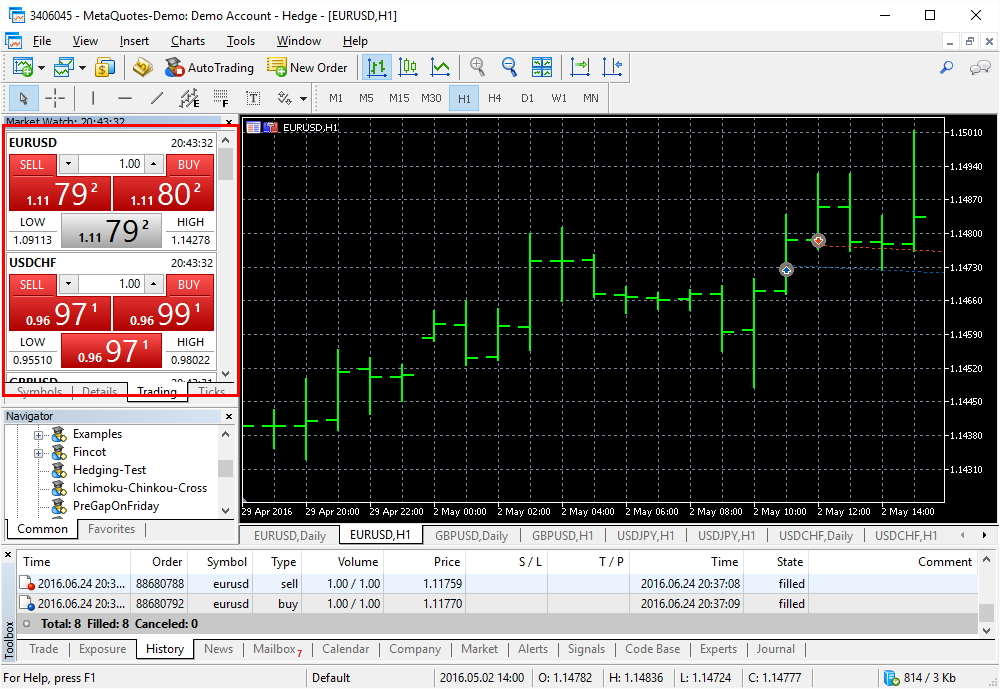

MT4 terminal’s workspace looks like this:

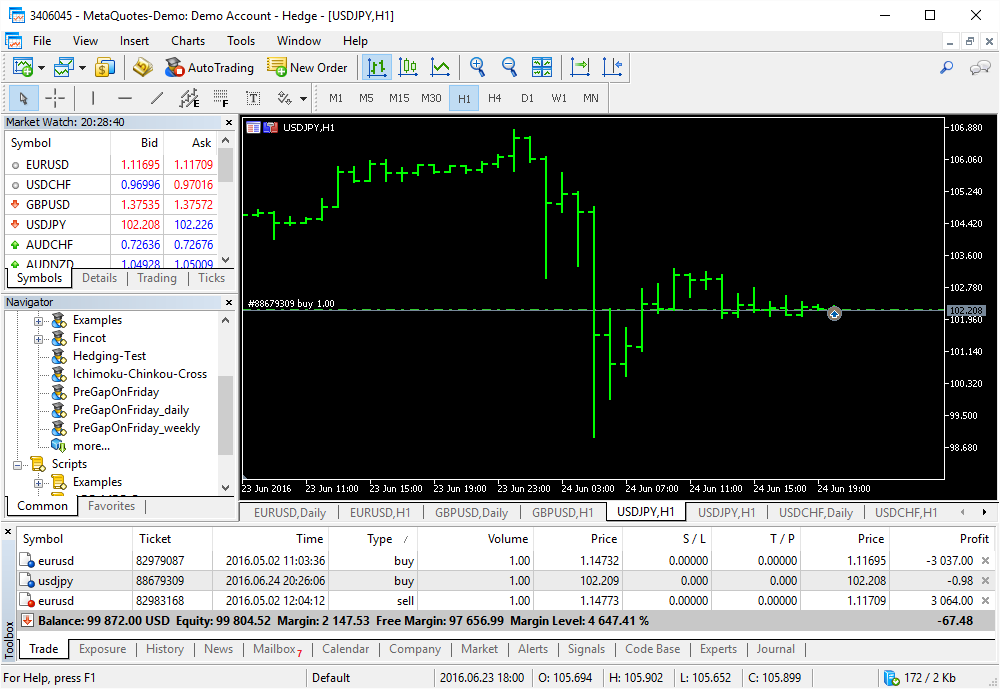

5th version’s design is nearly the same:

Timeframes

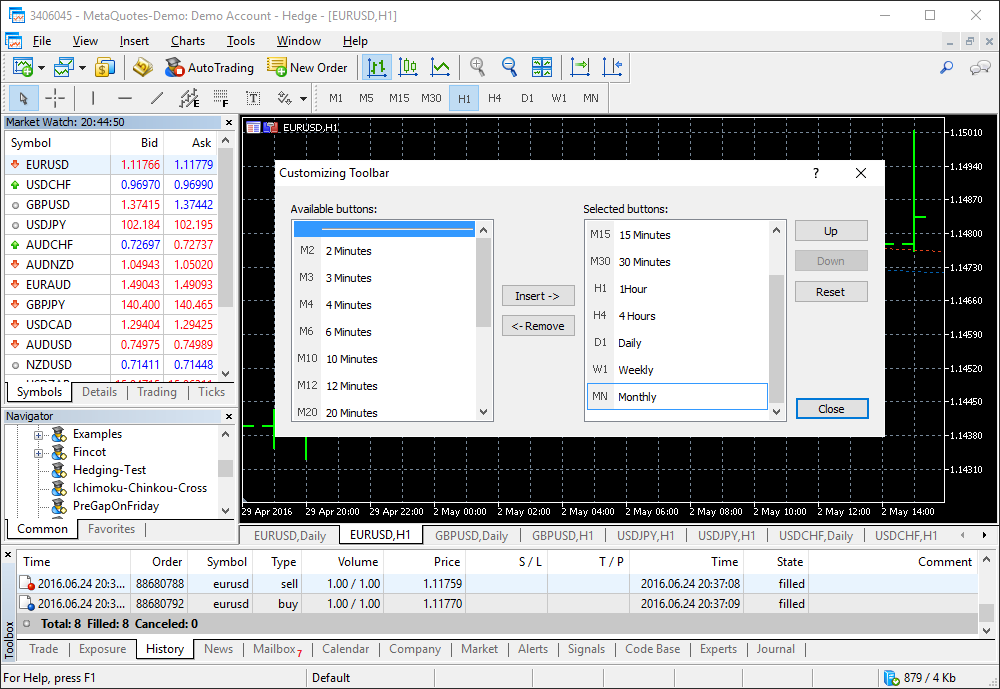

MT5 offers a greater number of timeframes. For example, there are 11 different types of minute charts and 7 hourly timeframes. All in all, 9 timeframes are available in MT4 versus 21 timeframes in MT5.

MT5 trading platforms offers 9 standard timeframes: M1, M5, M15, M30, H1, H4, D1, W1, and MN. The assortment of time periods in MT5 terminal is much wider. In addition to the timeframes presented in MT4, the 5th version boasts the following ones: M2, M3, M4, M6, M10, M12, M20, H2, H3, H6, H8, H12.

In MT4 platform, you would need to use a special script to show non-standard timeframes on the chart. In MT5, you can just configure the timeframes for the top control panel:

Consider MT5, if you are keen on analyzing and trading multiple timeframes.

Trading

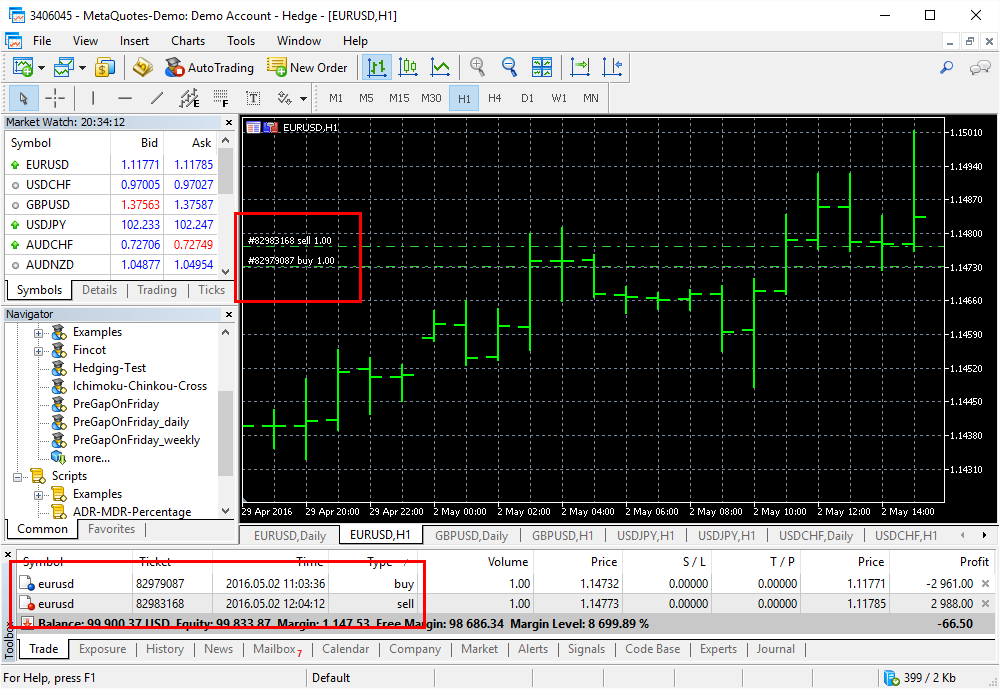

Previously, MT5 did not support position hedging. A trade executed in an opposite direction would close (partially or completely) the existing position. In April 2016, during platform’s update, MT4-like hedging has been introduced into MetaTrader 5.

At the same time, traders can still open accounts, which use netting position system (without hedging) at MT5 brokers.

In hedging mode, the trading account will show all positions opened for the same trading instrument at different prices and different time. In netting mode, such positions would be aggregated together. The terminal would be showing net volume and average price.

Order management

In the latest version of MetaTrader, you can drag-and-drop the stop-loss and take-profit levels with your mouse. This feature works in normal mode and in One Click Trading mode. The difference is that the former requires manual confirmation for each SL or TP change while the latter means instant change of the respective trading levels.

This feature, in MT4 terminal, works only with One Click Trading mode turned on. The price change is instant. MT4 and MT5 work similarly in this regard. However, if One Click Trading is turned off in MT4, the order modification is more difficult. The Market Watch window, in MT5, features a tab for quick access to the One Click Trading panel:

Pending orders

MT4 has 4 types of pending orders: Sell Limit and Sell Stop, Buy Limit and Buy Stop. In MT5, there 2 additional orders:

Sell Stop-Limit and Buy Stop-Limit.

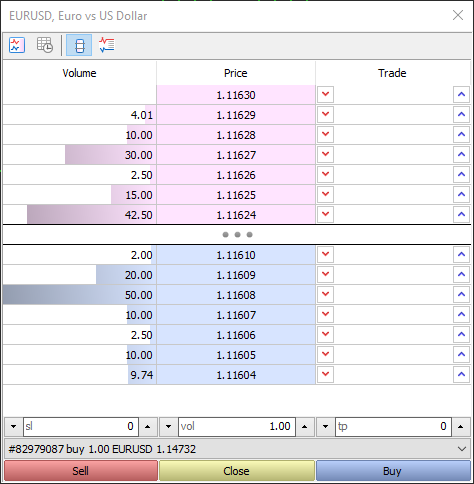

Choice of financial instruments and market depth

A much wider assortment of financial instruments are offered in MT5, compared to MetaTrader 4. Traders can operate not only in currency pairs, metals, and CFDs, but also in futures, indices, and equities. MT5 is adapted for handling the exchange-traded instruments, unlike MT4, which is OTC in its nature.

Native Depth of Market view is provided in MetaTrader 5 to see the relevant price and volume levels for a given trading instrument:

MT4 has nothing like this. The best it can offer is the view of latest executed price levels.

Report

MT5 terminal has enhanced reporting compared to MT4. It lets forming report as an Open XML document, which can be further processed in Excel or Calc. It can be useful for analysis of your trading strategy.

In MT4 traders can save the account report only in HTML format using the standard approach. Traders can use third-party scripts to produce Excel/Calc reports. MT5 replaces this approach with an easy solution. Additionally, MT5 offers reports in any of the platform’s supported language whereas MT4 can produce reports only in English.

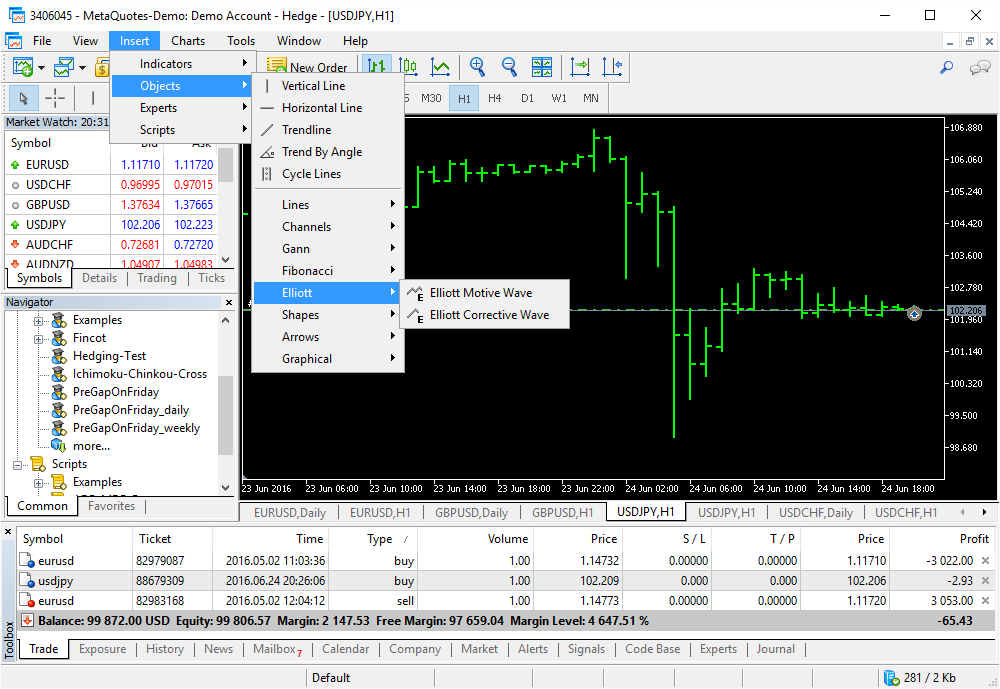

Capabilities

In MetaTrader 4 you can choose from 30 built-in indicators, over 2 000 free custom indicators and 700 paid ones, as well as 24 analytical objects. Meta Trader 5 offers 38 technical indicators and 44 graphic objects, which are available for a comprehensive market analysis. It’s also possible to download additional indicators. In conclusion: both programs (MT4 and MT5) have a big variety of analytical tools.

The platform’s analytical capabilities have been upgraded in the 5th version. The standard list of lines, icons, and other graphical objects has been revamped. New charting objects have been introduced. Traders who prefer Elliott Wave analysis can now add waves with just a few mouse clicks, which is something that 4th version of the platform lacks.

The number of built-in indicators has been increased. Custom technical indicators are now easier to search and install. In MT4, you would need to download an indicator file and copy it into the indicators’ folder. Then, you would need to restart the platform.

In the 5th generation platform, you can install trading robots, indicators, and scripts directly from the terminal. You can do it by accessing the CodeBase repository either by pressing F2 or by via menu Tools->MetaQuotes Language CodeBase. Then, you just need to right-click the indicator/EA/script that you like and choosing Download.

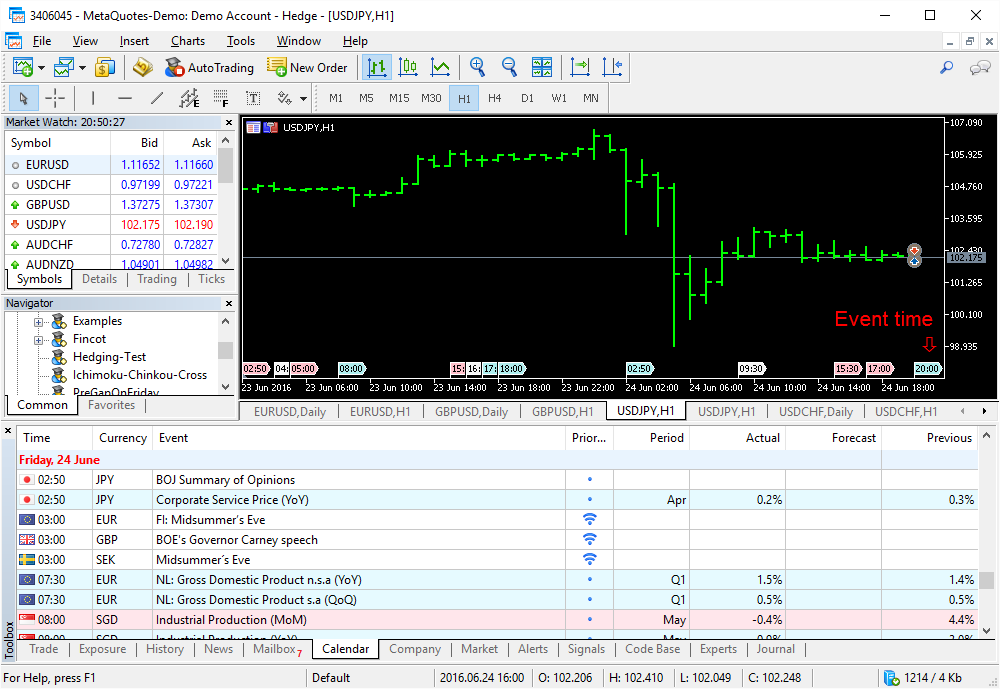

Compared to MT4, the lower part of the terminal (Toolbox) has two new tabs. The Company tab grants the trader direct access to his or her trading cabinet at the broker’s website. The Calendar tab gives quick access to the schedule of important economic events without having to visit third-party Forex calendars. Moreover, the Calendar’s information is also featured directly on chart in form of special timed banners. MT4 has no such features.

Economic calendar

MT5 has a built-in economic calendar, unlike MT4. To access it click “View” and choose “Toolbox”.

Hedging, i.e. the ability to open multiple positions (buy and sell) at the same time for the same symbol, is allowed is both terminals. Both versions of the trading platform allow traders to use automated, i.e. to test, apply and develop Expert Advisors (trading robots) and technical indicators.

To make a conclusion, MetaTrader 4 is simpler to use and is the best choice for beginners who want to focus on the Forex market. It has become a standard for the industry and many traders like its interface. The best choice for those who require in-depth analysis and a wider range of trading instruments, can be the Meta Trader 5.

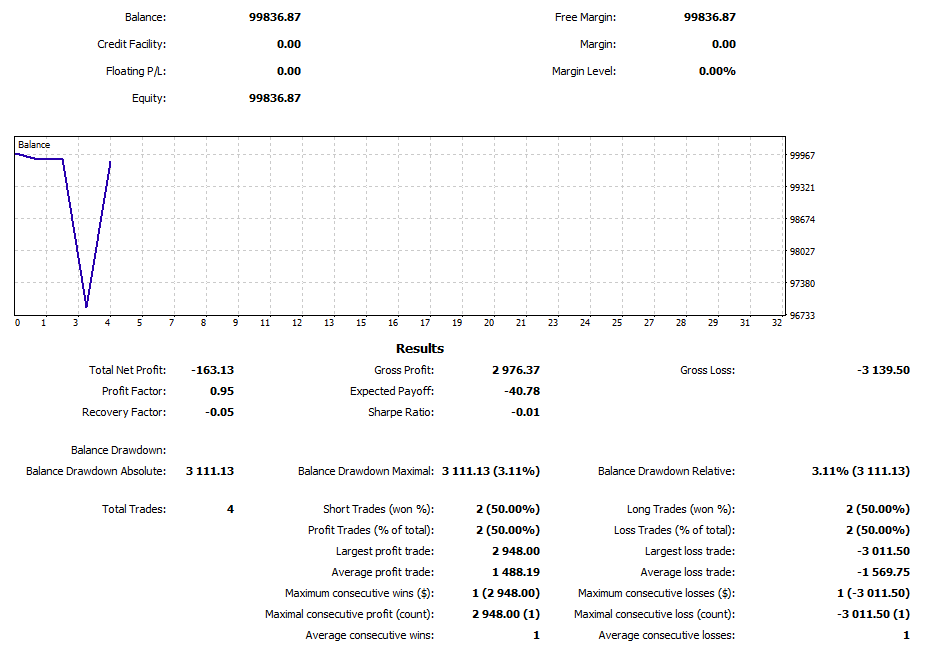

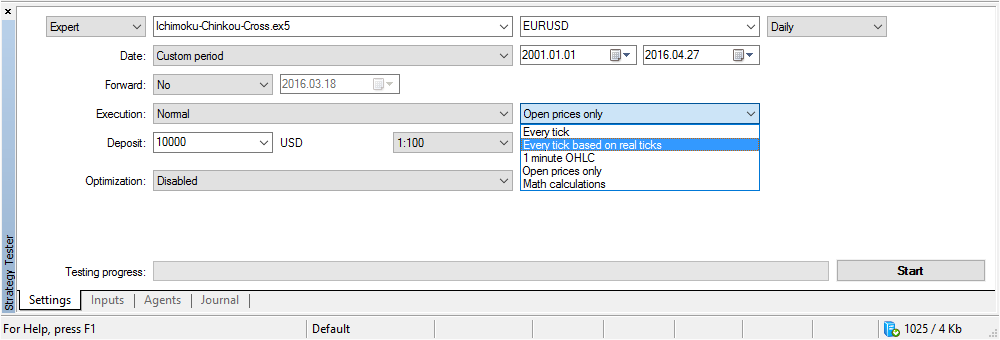

Strategy Tester

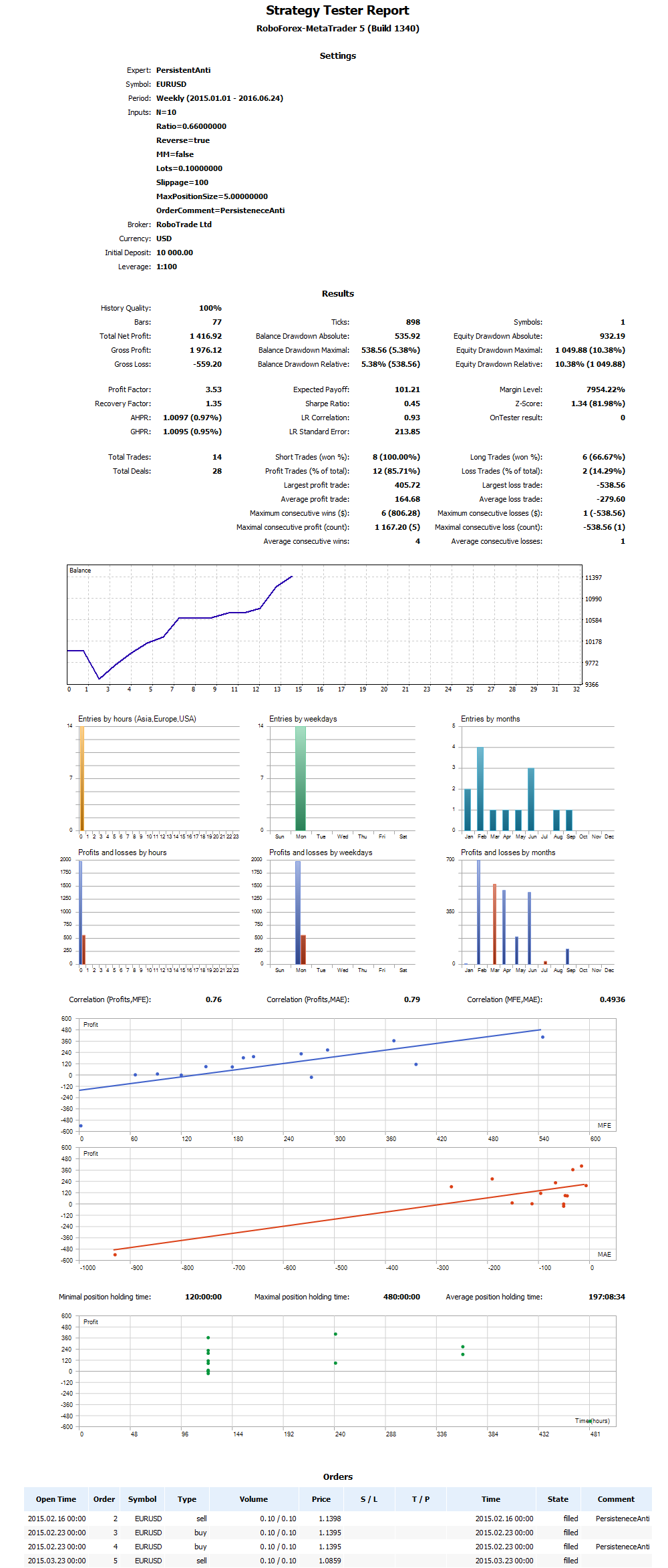

The Strategy Tester in the newest version of the platform allows backtesting on multiple currency pairs at once. Expert advisors can now trade several financial instruments during the test. All tested instruments should be visible in Market Watch. Additionally, backtesting on real tick data is possible in MT5. The closest thing offered by MT4 is modeled ticks based on M1 data.

Backtesting results report of MetaTrader 5 contains more parameters compared to the previous version. Now it will also show the charts for statistical metrics visualization. Here is an example of the backtest results for the PersistentAnti expert advisor:

You can now use several CPUs for faster backtesting. You can also lend your CPUs to other traders for backtesting purpose and earn money for it. You cannot do this with MT4.

Trading robots

Software for MetaTrader 5 and MetaTrader 4 is written in different languages. The first one uses MQL4. The second one uses MQL5. In most cases, it is impossible to compile MQL4 code in MT5 and vice versa without significant modifications.

In MT5, you can use MQL5 Wizard, which is built in MetaEditor coding IDE, to create simple expert advisors and indicators in just a few clicks.

Conclusions

MetaTrader 5 platform can now boast all the features of the previous version of the platform. Inception of the hedging accounts gave boost to the number of interested clients and its popularity in the Forex industry. The latest release of MT5 surpasses MT4 by offered function and by usability.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.