This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

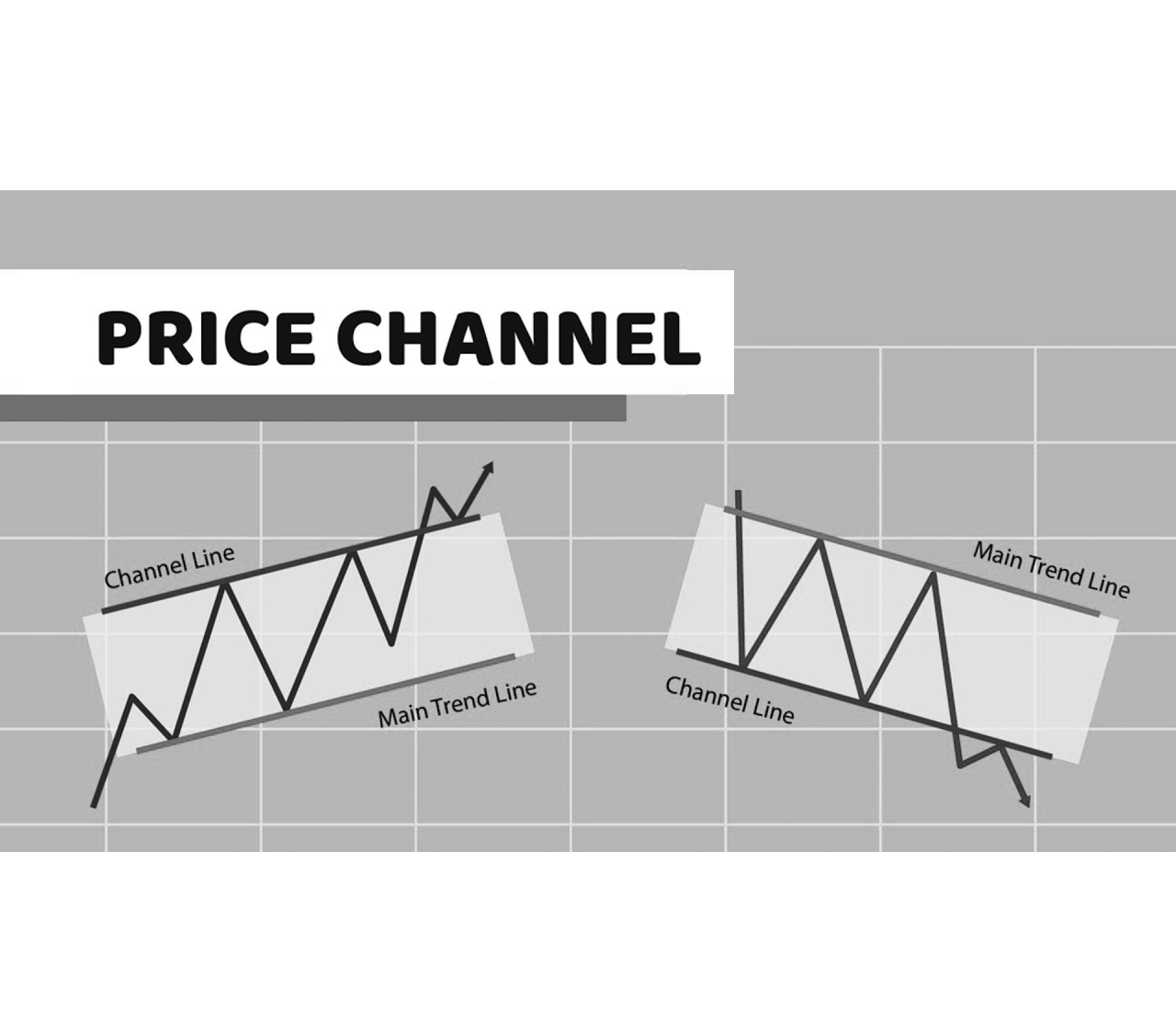

The channel is a powerful but often overlooked chart model and combines several forms of technical analysis to provide traders with potential entry and exit points as well as risk control. The first step is to learn how to identify the channels. The next steps include determining where and when to enter a trade, where to place stop-loss orders, and where to pick up winnings.

Channel characteristics

In the context of technical analysis, a channel arises when the price of an asset moves between two parallel trend lines. The upper trend line connects the swing peaks in the price, while the lower trend line connects the swing bottoms. The channel can be tilted up, down or sideways on the chart

If the price goes up from the trading channel, it may mean that the price will rise further. For example, the chart below shows a channel and a breakout in shares of Hyatt Hotels Corporation (H). If the price breaks below the bottom of the channel, on the other hand, the decline indicates that there may be more sales.

The trading channel technique often works best on stocks with a medium level of volatility, which can be important in determining the amount of profit possible from a trade. For example, if volatility is low, then the channel will not be very large, which means smaller potential gains. Larger channels are usually associated with greater volatility, which means higher potential gains.

Types of channels

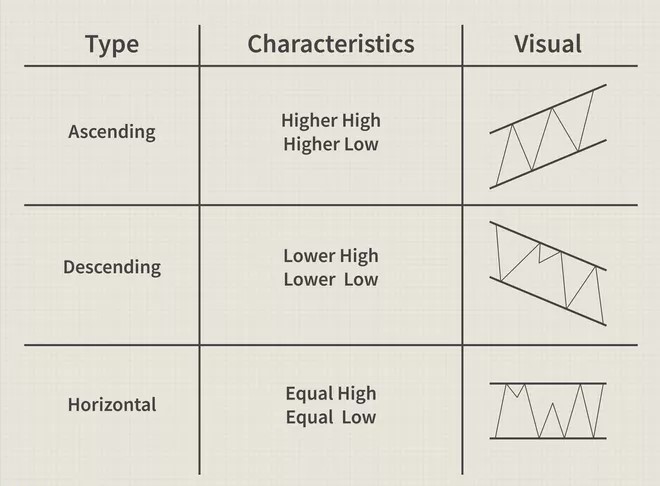

The channel consists of at least four contact points, because we need at least two low levels to connect to each other, and two high ones to connect to each other. Generally speaking, there are three types:

- Channels that are at an upward angle are called ascending channels.

- The channels that are at an angle downwards are descending channels. Ascending and descending channels are also called trend channels, as the price moves more dominantly in one direction.

- Channels in which trend lines are horizontal are called horizontal channels, trading ranges or rectangles.

Buying or shorting the channel

Channels can sometimes provide points for buying and selling and there are several rules for entering long or short positions:

- When the price reaches the top of the channel, sell your existing long position and / or take a short position.

- When the price is in the middle of the channel, do nothing if you have no trades, or keep your current trades.

- When the price reaches the bottom of the channel, cover your existing short position and / or take a long position.

There are two exceptions to these rules:

- If the price breaks through the top or bottom of the channel, then the channel is no longer intact. Don’t start any more trades until a new channel is developed.

- If the price moves between channels for an extended period of time, a new narrower channel may be established. At this point, enter or exit near the endpoints of the narrower channel.

During a rising channel, focus on buying near the bottom of the channel and exiting near the top. Be careful with shorting, as the trend is up. For example, an uplink channel is depicted below in shares of NVIDIA Corporation (NVDA).

During a descending channel, focus on a short circuit at the top of the channel and an exit near the bottom. Be careful when starting longs in a descending channel, as the trend is downward.

Other forms of technical analysis are sometimes used to increase the accuracy of channel signals and to check the total force of upward or downward movement. Some other tools to use during channel trading include:

- The divergence of the moving average convergence (MACD) will often be close to zero during horizontal channels. The MACD line crossing the signal line may also indicate potential long trades at the bottom of the channel or short trades at the top of the channel.

- A stochastic crossover can also signal an opportunity to buy near the bottom of the channel or an opportunity to sell near the top.

- Volume can also help in trading channels. The volume is often lower in the channels, especially near the middle of the channel. Breakthroughs are often associated with large volumes. If the volume does not increase in a breakout, the channel is more likely to continue.

Determining stop-loss and take-profit levels

Channels can provide stop loss and take profit levels in the form of built-in money management capabilities. These are the basic rules for determining these levels:

- If you bought at the bottom of the channel, go out and take your winnings at the top of the channel, but also place a stop loss order just below the bottom of the channel, leaving room for regular volatility.

- If you have taken a short position at the top of the channel, go out and take a profit at the bottom of the channel. Also place a stop loss order just above the top of the channel, allowing room for regular volatility. You can find a descending channel in BCE Inc. (BCE) along with potential stop losses and exit points.

During a descending channel, focus on a short circuit at the top of the channel and an exit near the bottom. Be careful when starting longs in a descending channel, as the trend is downward.

Other forms of technical analysis are sometimes used to increase the accuracy of channel signals and to check the total force of upward or downward movement. Some other tools to use during channel trading include:

- The divergence of the moving average convergence (MACD) will often be close to zero during horizontal channels. The MACD line crossing the signal line may also indicate potential long trades at the bottom of the channel or short trades at the top of the channel.

- A stochastic crossover can also signal an opportunity to buy near the bottom of the channel or an opportunity to sell near the top.

- Volume can also help in trading channels. The volume is often lower in the channels, especially near the middle of the channel. Breakthroughs are often associated with large volumes. If the volume does not increase in a breakout, the channel is more likely to continue.

Determining stop-loss and take-profit levels

Channels can provide stop loss and take profit levels in the form of built-in money management capabilities. These are the basic rules for determining these levels:

- If you bought at the bottom of the channel, go out and take your winnings at the top of the channel, but also place a stop loss order just below the bottom of the channel, leaving room for regular volatility.

- If you have taken a short position at the top of the channel, go out and take a profit at the bottom of the channel. Also place a stop loss order just above the top of the channel, allowing room for regular volatility. You can find a descending channel in BCE Inc. (BCE) along with potential stop losses and exit points.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.