This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

Although prices may seem random, they do create recurring patterns and trends. One of the most basic repetitive patterns is the fractal. Fractals are simple five-bar reversal patterns. This article will explain fractals and how you can apply them to your trading strategy.

Introduction to Fractals

When people hear the word”fractal”, they frequently suppose of complex mathematics. We aren’t talking about that currently. Fractals also relate to a recreating pattern that appears against the background of larger, more chaotic price movements.

Fractals correspond of five or further bars. The rules for relating fractals are as follows

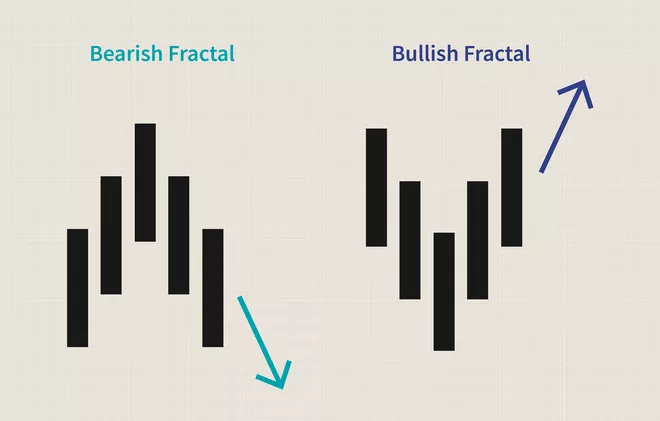

A bearish turning point occurs when there’s a pattern with two lower highs on each side and the highest in the middle.

A bullish turning point occurs when there’s a model with the lowest bottom in the middle and two high bottoms on each side.

The fractals shown below are two illustrations of perfect patterns. Keep in mind that numerous other minor perfect models can do, but this elementary model must remain complete for the fractal to be valid.

The obvious disadvantage currently is that fractals are dragging indicators. Fractal cannot be withdrawn until we are two days after turning. However, most significant turnovers will continue for more bars, which benefits the retailer. Once the pattern appears, the level is anticipated to get up after a bullish fractal or go down after a bearish fractal.

The Formulas for Fractals Are:

Bearish Fractal = High (N) > High (N−2) and

High (N) > High (N−1) and

High (N) > High (N+1) and

High (N) > High (N+2)

Bullish Fractal = Low (N) < Low (N−2) and

Low (N) < Low (N−1) and

Low (N) < Low (N+1) and

Low (N) < Low (N+2)

where:

N=High/low of the current price bar

N−2=High/low of price bar two periods

to the left of N

N−1=High/low of price bar one period

to the left of N

N+1=High/low of price bar one period

to the right of N

N+2=High/low of price bar two periods

to the right of N

How to calculate the fractal indicator

Calculating fractals has further to do with visual perceptivity than with mathematics.

- Isolate the high / low (N) point of the graph.

- If there are two lower peaks to the left of the highest or two higher lows to the left of the lowest (N-2 and N-1), there is a possible model. The model still needs two more bars on the right to confirm.

- If two lower maxima appear after the maximum, then the bear fractal is complete (N + 1 and N + 2). If two higher bottoms occur after the low one, the bullish fractal is complete.

What the fractal indicator tells you

The fractal indicator often generates signals. The existence of a fractal is not necessarily important, as the pattern is so common.

The fractal indicates the possibility of changing the trend. This is because fractals essentially show a “U-shaped” price. A bear fractal has a price that moves up and then down, forming an inverted U. A bullish fractal occurs when the price moves down, but then begins to move up, forming a U.

Because fractals are so usual and numerous flags aren’t trusty entry points, fractals are generally filtered applying another figure of technical analysis. Bill Williams also invented the alligator indicator, which isolates trends. A trader may decide to only trade bullish fractals signals by combining fractals with trend analysis, while the price trend is up. If the trend is downward, they can only make short deals with bearish fractal signals, for example.

Fractals can also be used with other indicators, such as pivot points or Fibonacci correction levels. The only way a fractal is efficient if it’s in line with one of these different indicators and potentially in the long- term direction of the price. For example, assume that stocks are moving higher. The price goes back and reaches 50% Fibonacci correction level. As the trend is up and the price is close to the Fibonacci correction level, the trader will make a deal if a bullish fractal is formed.

The difference between the fractal indicator and chart patterns

It identifies a price model and marks it on the chart, this makes the fractal indicator a unique. Fractals are specific models with five bands. Chart models can also be plotted on the chart, although they are not limited to five price bars. Diagram models also include many different shapes, such as triangles, rectangles, and wedges, to name a few. Most chart specialists find and isolate chart patterns by hand, while some software will mark chart patterns on a chart.

Applying Fractals to trading

Most charting platforms already provide fractals as a trading indicator. This means that retailers do not have to look for the model. Attach the indicator to the chart and the software will highlight all models. Once they do this, traders will notice an immediate problem: this pattern is common.

Fractals are best applied in confluence with another indicators or forms of analysis. A common validation indicator used with fractals is the alligator. This is a tool created using multiple moving averages. The following chart shows a long-term uptrend, with the price remaining substantially above the alligator’s teeth (moving average). As the trend is upward, bullish signals can be used to generate buy signals.

Although slightly confusing, the bear fractal is usually drawn on the chart with an up arrow above it. Bull fractals are drawn with an arrow down below them. Therefore, if using a fractal indicator provided in most charting platforms and fractals in an overall uptrend, look for the down fractal arrows. If you are looking for bear fractals to trade in a larger downtrend, look for fractal up arrows.

Occasionally, for a cleaner look to the chart, shifting to a longer time frame will disrate the number of fractal flags, permitting forming it fluent to spot trading chances.

This system provides entries, but it is up to the trader to control the risk. In the case above, the model is not recognized until the price starts to rise from a recent low. Therefore, the stop loss can be put below the recent bottom once the deal is done. If it is short, during a downtrend, the stop loss can be placed above the recent peak. This is just one example of where to put a stop loss.

Another strategy is to use fractals with Fibonacci correction levels. One of the problems with fractals is which of the events to trade. And one of the problems with Fibonacci correction levels is which correction level to use. Combining the two will narrow the possibilities, as the Fibonacci level will only be traded if a fractal reversal occurs outside that level.

Traders also tend to focus on deals at certain Fibonacci ratios. This may vary according to the trader, but let’s say that the trader prefers to make long trades during a larger uptrend when the price returns to the level of adjustment of 61.8%. Fractals can be added to the strategy: the trader only trades if a fractal turnaround occurs close to the 61.8% correction, and all other conditions are met.

The chart below shows this in action. The price is in a general upward trend and then pulls back. The price forms a bullish fractal twist close to the level of 0.618 of the Fibonacci correction instrument. Two days after the bottom, once the fractal is visible, a long trade begins in line with the long-term uptrend.

Profiting can also involve the use of fractals. For example, if a long fractal ascends, the trader may leave the position after a bear fractal appears. Other exit methods can be used, such as profit or loss targets.

Limitations of using the fractal indicator

There are so many of them, this is the main problem with fractals. They appear frequently and attempts to trade all of them will quickly deplete the trading account due to losing trades. These are called false signals or shocks. With some other indicator or form of analysis, you can filter the signals .

The arrows for the indicator are usually drawn above the highest or lowest point or the point that is the center of the fractal, not where the fractal ends. Therefore, arrows can be visually deceptive. Since the model actually ends two bars to the right of the arrow, the first available entry point after seeing an arrow is the cost of opening the third bar to the right of the arrow.

Further considerations on using Fractals

Keep in mind the following things when using fractals.

- They are lagging behind.

- Because fractals are very common, they combine best with other indicators or strategies. They should not be relied on in isolation.

- The longer the time period of the chart, the more solid the reversal. The longer the time period, the lower the number of signals generated, this is also important to note.

- It’s smart to draw fractals in numerous time frames. For sample, trade just short- term fractals in the direction of long- term ones. As discussed, focus on long trading signals during large uptrends and focus on short trading signals during large downturns.

- Most graphics platforms now include fractals in the list of indicators.

The bottom line

Fractals can be practical tools when applied in combination with other indicators and strategies. Fractals can be used in many different ways and each trader can find his own variation. The use of an alligator indicator is one option and the use of Fibonacci correction levels is another. While some retailers may like fractals, others may not. They aren’t a necessity for successful trading and shouldn’t be depended on purely.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.