This publication aims to help fulfil the mission of “Applications In Life” Fondation to support and develop accessible and understandable financial education by improving financial culture and forward-thinking mentality of the civil society.

With some experience, the trader will understand that it is possible to improve his trading results not only through market analysis, but also with the help of other techniques. In particular, it is possible to manage the size of an open position to limit risks and increase profits. Are you interested? Then let’s get into it.

Scaling in a trade

Scaling implies an increase in trade, which is already showing a profit. It is very useful at times when you think a new trend may start, but you are not really sure and want to reduce your risk exposure. This approach is sometimes called “pyramiding”.

Scaling will only reduce the risk if you open a smaller trade than you normally do according to your money management rules. In other words, scaling involves entering a piece trade. You will also need to pre-select the levels at which to add to your position.

Note that you can only add to a position by opening a new order at the current market price. So, while we logically see it as “adding to a deal”, scaling actually means that you make multiple positions in the same direction at different predetermined price levels (once the price reaches those levels).

Example

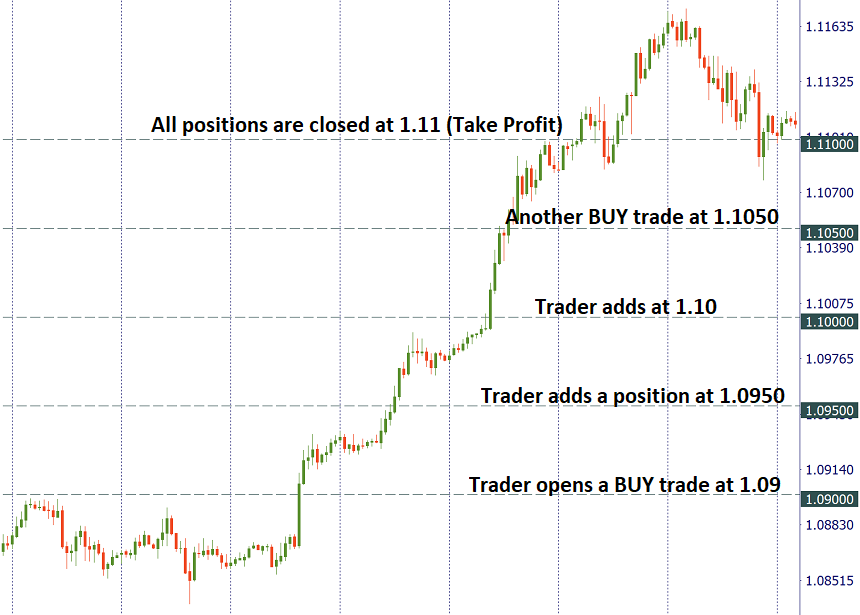

Let’s say you wanted to buy EUR / USD at 1.09, targeting 1.11, but you weren’t sure about this trade. To reduce your risks, you decided to scale: you broke your usual trading size (for example 1 lot) into 4 parts (0.25 lots each) and defined the levels at which you will open new buy positions (in this case the trade is just increased every 50 pips).

You can use a variety of tools to determine the levels you will add to your trade: Fibonacci, turning points, key previous highs and lows, and more.

Scaling protects you in the event of an accident. If you open the whole position to buy 1 lot at 1.09 and then the market turns down, your loss would be 4 times bigger than the loss you would have if you opened a deal with 0.25 lots. At the same time, if you don’t open this trade at all and the price really goes up, you would miss the chance to join the trend at the earliest stage.

It would be wise to trail your stop loss after the price each time you add a new position, so that you never risk more than you decided to risk in one trade.

Note that scaling is not recommended for range-bound markets or periods when the price tends to make sharp back and forth movements. Scaling is more appropriate for trend and breakout trading.

Overall, scaling helps reduce risks while increasing profits. This is a very good combination in terms of risk management. Still, try to pay attention and not to get carried away: it’s not wise to scale in every profitable trade. Remember that the decision to scale must be made in advance before opening a deal. If you did not think this or did not think it might be necessary at the time, then treat such a trade as normal and do not try to add to it.

Scaling out of a trade

Scaling out implies partial closing of a winning trade. Why would anyone have to close a trade that shows a profit?

Imagine riding the trend for a while. The longer the trend continues in the same direction, the greater the risk that it will end. At the same time, it is in your best interest to ride the trend as long as possible before the market turns.

Here, scaling out will help: by closing part of your position, you reduce your risks in the event of a reversal. At the same time, you retain the ability to keep open trading, and if the trend continues, you will gain more than you would if you closed trading earlier.

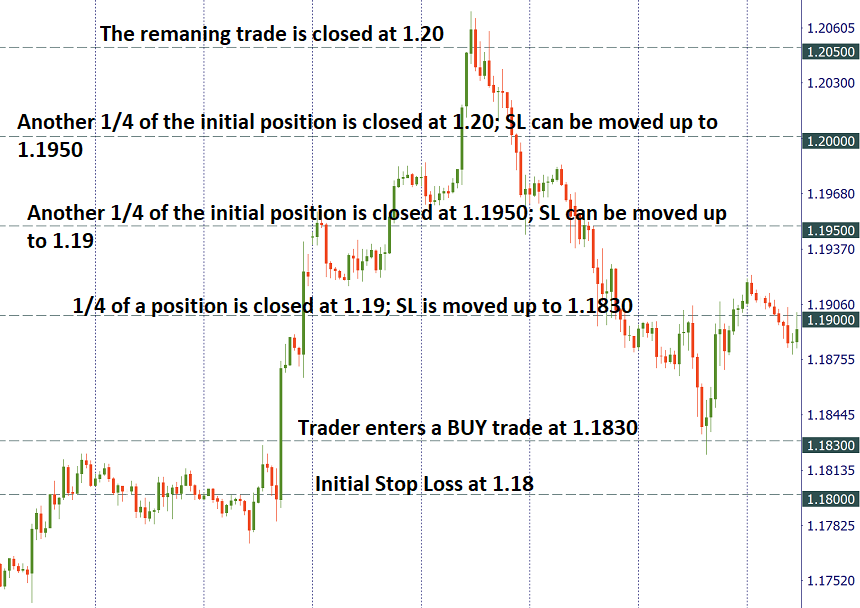

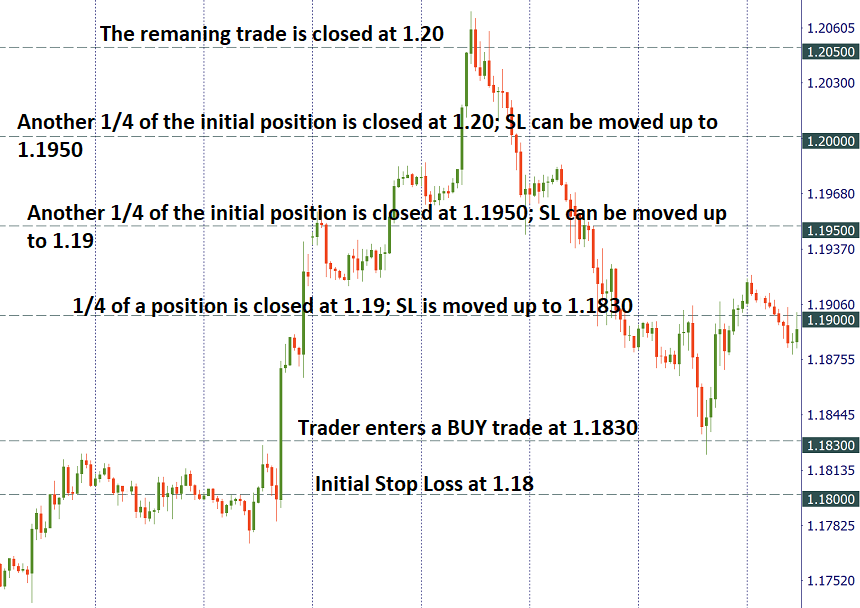

A good option is to combine scaling out with moving a Stop Loss order to the entry point. For better understanding, check the following example.

You found a position to buy at 1.1830, aimed at moving up at least to 1.1900 zone with a Stop Loss of 1.1800. When the price reached 1.1900, it continued to rise. This gave you an idea to reduce the size of this trade. You decided to close ¼ from the position and move your stop loss to the safety point (1.1830). That way, if the market doesn’t go your way, you’ll have small profit and you won’t lose anything if the SL is hit.

However, if the price rises in line with your expectations, you will have a chance to win for more ¼ from the position of 1.1950 and then at 1.2000, before the last part of your trade is closed at 1.2050. That way, you could trade a big trend without risking anything once your SL has been moved to a no-loss level.

Scaling out can be used when trading trends or breakouts, when the price is moving fast in one direction and you are not sure whether the volatility will continue to drive the market or change it. There is no point in scaling if you are trading in a range.

To partially close a deal with MT4, go to the “Trading” tab in “Terminal”. Double-click the transaction you want to change. An order window will appear. In Volume, enter the amount you want to close or select from the drop-down menu. Click the yellow “Close # ..” button. When finished, you will receive a confirmation of the closed part.

These were safe and effective methods for managing the size of your position. Next, we will explain the techniques that are not so safe and thus can lead to bad and risky results.

Averaging down

This means an increase in the losing trade. Some traders do this in the hope that the price will reverse and the addition to the trade will allow them to enter the market at better levels. Be aware that losses always make traders feel the pressure. This can blur the judgment and lead to any bad decisions. We recommend that you stay away from these tactics and increase only profitable trades.

Martingale system

The Martingale system is an investment system in which the dollar value of the investment continues to increase after losses or the size of the position increases as the size of the portfolio decreases. The Martingale system was introduced by the French mathematician Paul Pierre Levy in the 18th century. The strategy is based on the premise that only one good bet or trade is needed to turn your fortune upside down.

The Martingale system is a risk-seeking investment method. The basic idea behind the Martingale system is that statistically you can’t lose all the time, so you have to increase the amount allocated to investments – even if they decrease in value – in anticipation of a future increase.

Martingale strategies rely on the theory of averaging. Without an abundance of money to achieve positive results, you have to endure missed deals that can bankrupt an entire account. It is also important to note that the risk amount for trading is much higher than the potential profit. Despite these shortcomings, there are ways to improve your martingale strategy that can increase your chances of success.

The Martingale system is often compared to casino betting in the hope of achieving balance. When a gambler who uses this method suffers a loss, they immediately double the amount of the next bet. By doubling the bet many times over, when he loses, the gambler will, in theory, eventually equalize with a profit. This suggests that the gambler has an unlimited supply of betting money, or at least enough money to make a profitable profit. In fact, just a few consecutive losses on this system can lead to the loss of everything you came up with.

Basic example of the Martingale system

To understand the basics of the strategy, let’s look at a basic example. Suppose you have a coin and participate in a game of betting on heads or tails with an initial bet of $ 1. There is an equal probability that the coin will land on heads or tails and each turn is independent. (The previous inversion does not affect the result of the next inversion.)

As long as you stick to the same call either in heads or in tails, you would end up getting an infinite amount of money to see the coin land on the heads (or tails) – if that’s your call – and thus be recover all losses plus $ 1.

Let’s say you have $ 10 to bet, starting with the first bet of $ 1. You bet on heads, the coin is turned over this way and you win $ 1, increasing your equity to $ 11. Each time you succeed, you keep betting the same $ 1 until you lose. The next flip is a loser and you return the capital to your account up to $ 10. On the next bet you bet $ 2 to recover your previous loss and bring your net profit from $ 0 to $ 2. Unfortunately it lands in queues again. You lose another $ 2, reducing your total capital to $ 8. By completing the martingale strategy, you double your bet to $ 4 on the next bet. Fortunately, you hit a winner and win $ 4. This brings your total capital to $ 12. As you can see, all you need was one winner to recoup all your previous losses.

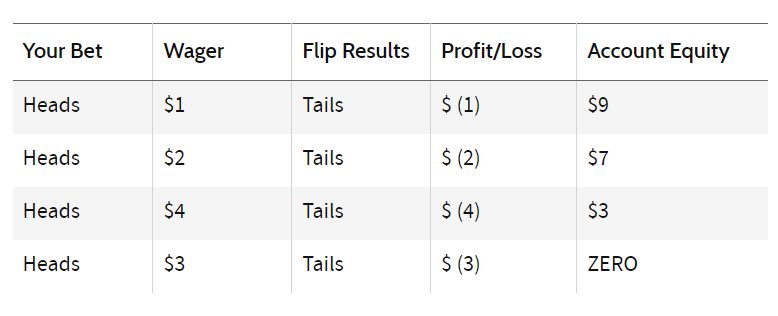

But let’s think about what happens when you hit a series of losses:

Again, you have $ 10 to bet, with the starting bet being $ 1. In this case, you immediately lose on the first bet and reduce your balance to $ 9. You double your bet on the next bet, lose again, and end up with $ 7. On the third bet, your bet reaches $ 4. Your lost streak continues as you drops to $ 3. You don’t have enough money to double and the best thing you can do is bet everything. Then you go down to zero when you lose, so no combination of strategy and luck can save you.

Anti-Martingale System

The anti-Martingale system, or reverse Martingale, is a trading methodology that involves halving the bet every time there is a trade loss and doubling it every time you make a profit. This technique is the opposite of the Martingale system, in which a trader (or gambler) doubles a lost bet and halves a winning bet.

Both systems are trading strategies often used in foreign exchange markets, but can be applied elsewhere.

The assumption of the anti-Martingale system is that a trader can instead capitalize on a winning streak by doubling his position. The anti-Martingale system accepts greater risks during periods of expansive growth and is considered a better system for traders because it is less risky to increase trade size during a winning streak than during a losing streak. This type of thinking may fall into the “hot hand fallacy” trap, but when markets are trending up, the anti-Martingale system could be successful for a trader, who may pick off a series of positive trades before a loss interrupts his streak. However, doubling a winning bet exposes it to a big loss that can destroy previous winnings.

When there is a loss, you end up halving a lost bet. Here, the trader practically practices the stop-loss discipline, which is usually recommended in trade. The anti-Martingale system is somewhat a game of Wall Street’s maxim “let your winners win and cut your losers early.” It can serve well in inertial markets, but markets can quickly turn against traders. The Martingale system, on the other hand, is more of a “return to average” scheme that may be more appropriate in undirected, winding markets.

Example of the Anti-Martingale System

To understand the basics of the strategy, let’s look at a basic example. Suppose you have a coin and participate in a $ 1 head or tail betting game. There is an equal chance that the coin will land on heads or tails and each flip is independent (the previous flip does not affect the result of the next flip) . Suppose you always bet on heads.

If the first roll is indeed heads, you will win $ 1 and then bet $ 2. If it is heads again, you will receive $ 4 on the next flip. These are queues and you will halve your next bet and bet $ 2 again.

The bottom line

A great deal of caution is needed for those trying to practice these strategies, however appealing they may sound to some traders. The main problem with these strategies is that seemingly secure trades can blow up your account before you can win or even recoup your losses. Ultimately, traders need to consider whether they are willing to lose most of their equity in one account. Given that they have to do this to average much smaller profits, many believe that the martingale trading strategy offers more risk than reward.

Disclaimer: The publications on this platform aim to provide useful information on financial topics. But they are NOT financial consultation or advice. Therefore they should not be used as a recommendation for making an investment decision on any type of financial products and services. We use in-depth research in the field but do not guarantee the completeness of the published materials. Always consult a specialist in your particular situation. "Applications In Life" Foundation is not responsible for any adverse consequences resulting from actions taken based on the information provided on the platform.